Mortgage Blog

Get The Mortgage You Deserve Today.

Category: Mortgages (120 posts)

Could Mortgage Rates Start to Rise Sooner than Expected?

March 23, 2021 | Posted by: Lam Lee

While Canada’s economy recorded its largest-ever annual GDP drop of 5.1% last year, it’s also on track to post a comeback in Q4, which could force the Bank of Canada’s hand in reinin ...

read more9 Ways to Keep Your Credit Score as High as Possible (Part II)

February 18, 2021 | Posted by: Lam Lee

In our previous post, we spoke about the fact that there are so many credit score providers out there, all providing different results, and chances are none of those results are the credit score ...

read moreWhy Is My Credit Score Different From What Lenders See? (Part I)

February 18, 2021 | Posted by: Lam Lee

It’s pretty easy to track your credit score these days—perhaps through a paid subscription to Equifax Canada or Trans Union Canada, or through free offerings from your ba ...

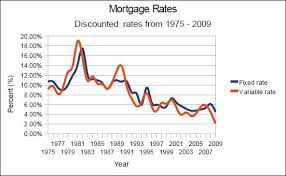

read moreFixed or Variable? Floating-Rate Mortgages Losing Their Lustre

September 23, 2020 | Posted by: Lam Lee

It can be one of the most difficult choices for mortgage borrowers—fixed rate or variable? Thanks to historically low spreads between the two, that choice is becoming easier for many. “I ...

read moreStress Test Rate to Fall to 4.79%

August 12, 2020 | Posted by: Lam Lee

The stress test rate is about to fall for the second time in three months following cuts by Canada’s Big Six banks to their 5-year fixed posted rates. Mortgage experts say the Bank of Canada wi ...

read more9 Ways to Keep Your Credit Score as High as Possible

July 17, 2020 | Posted by: Lam Lee

How are you supposed to optimize your credit score when you don’t even know what it is? The answer is by focusing more on your overall “credit hygiene” rather than on any one particu ...

read moreMortgage Rates Keep Setting New Record Lows

July 2, 2020 | Posted by: Lam Lee

While mortgage rates have been tumbling steadily over the last couple of months, many are now in record-setting territory, with certain 1- to 5-year fixed rates now available for under 2.00% from disc ...

read moreCMHC Makes It More Difficult To Get An Insured Mortgage

June 11, 2020 | Posted by: Lam Lee

Once again, the Canadian Mortgage and Housing Corporation (CMHC) is tightening the criteria to get a mortgage with less than a 20% down payment. Any potential home buyer with less than a 20% down paym ...

read moreFive Tips to Increase Your Credit Score Quickly

June 11, 2020 | Posted by: Lam Lee

In order to qualify for certain mortgage and loan products, a minimum credit score is essential. Even if your score is sufficient to qualify, you might find the rates being offered will be lower than ...

read moreWhy Are Mortgage Rates Rising?

May 14, 2020 | Posted by: Lam Lee

Over the past month, the Bank of Canada has lowered its overnight rate by a whopping 1.5 percentage points to a mere 0.25%. Many people expected mortgage rates to fall equivalently. The banks have red ...

read moreINTEREST RATES NOSEDIVE AS BANK OF CANADA CUTS RATES 50 BPS

May 7, 2020 | Posted by: Lam Lee

The Bank of Canada Brings Out The Big Guns Following yesterday’s surprise emergency 50 basis point (bp) rate cut by the Fed, the Bank of Canada followed suit today and signalled it is poised to ...

read moreMORNEAU EASES STRESS TEST ON INSURED MORTGAGES

April 30, 2020 | Posted by: Lam Lee

The federal government announced on Tuesday it will be changing the benchmark qualifying rate used for Canada’s insured mortgage stress test. The change, which will take effect April 6, 2020, m ...

read moreTD LOWERS QUALIFYING MORTGAGE RATE 35 BPS TO 4.99%

April 23, 2020 | Posted by: Lam Lee

CANADIAN QUALIFYING MORTGAGE RATE LOWERED TO 4.99% Market interest rates have fallen sharply since the coronavirus-led investor flight to the safety of government bonds. The 5-year government bond yi ...

read moreBank of Canada Holds Steady Despite Economic Slowdown

April 16, 2020 | Posted by: Lam Lee

In a more dovish statement, the Bank of Canada maintained its target for the overnight rate at 1.75% for the tenth consecutive time. Today’s decision was widely expected as members of the Govern ...

read moreHOW TO VERIFY YOUR DOWN PAYMENT WHEN BUYING A HOME

April 9, 2020 | Posted by: Lam Lee

Saving for a down payment is one of the biggest challenges facing people wanting to buy their first home.To fulfill the conditions of your mortgage approval, it’s all about what you can prove (h ...

read more6 THINGS ALL CO-SIGNORS SHOULD CONSIDER

April 2, 2020 | Posted by: Lam Lee

Co-signing on a loan may seem like an easy way to help a loved one (child, family member, friend, etc. ) live out their dream of owning a home. In today’s market conditions, a co-signor can offe ...

read moreMORTGAGE RENEWALS WITH THE SAME LENDER ARE ON THE RISE, BUT SHOULD YOU JUST SIGN ON THE DOTTED LINE?

March 26, 2020 | Posted by: Lam Lee

If you’re in a mortgage that’s coming up for renewal in the coming months and you’re considering just staying with your current lender, you wouldn’t be alone.According to the C ...

read more5 WAYS YOU COULD USE A CHIP REVERSE MORTGAGE

March 19, 2020 | Posted by: Lam Lee

Reverse mortgages are continuing to grow as a retirement solution for Canadians 55+. Homeowners 55+ are unlocking their home equity for tax-free funds that improve their cashflow and pay-off higher in ...

read more5 MISTAKES FIRST TIME HOME BUYERS SHOULD AVOID

March 12, 2020 | Posted by: Lam Lee

Buying a home might just be the biggest purchase of your life—it’s important to do your homework before jumping in! We have outlined the 5 mistakes first time homebuyers commonly make, and ...

read moreFIXED RATES OUTWEIGHING VARIABLE

March 5, 2020 | Posted by: Lam Lee

We are currently in a very unique situation when it comes to 5-year fixed and 5-year variable interest rates. For the first time in almost a decade, the lowest 5-year fixed interest rate is more than ...

read moreHELPING FAMILIES ONE AT A TIME

February 27, 2020 | Posted by: Lam Lee

Every once in a while you get to help people out and make a real difference in their lives. Recently a couple was referred to me who wanted to renew their mortgage. The bank that they had been dealing ...

read moreFIRST TIME HOME BUYERS INCENTIVE PROGRAM

February 20, 2020 | Posted by: Lam Lee

The new First Time Home Buyer Incentive program from CMHC (Canadian Mortgage and Housing Corporation) was officially released on September 2. This program was met with mixed reactions across the mortg ...

read more4 WAYS TO MAKE THE MORTGAGE PROCESS SMOOTHER

February 13, 2020 | Posted by: Lam Lee

Mortgages are complicated—we get it! But there are steps that you as a homebuyer can take to make the process a much smoother one (plus let you walk away with the sharpest rate!) 1. Use a Broke ...

read moreRENT-TO-OWN EXPLAINED

February 6, 2020 | Posted by: Lam Lee

In some markets, it can take a long time to sell a property. An option available to some sellers is the Rent-to-Own sales method. If you have someone interested in purchasing your property but they c ...

read moreNEED AN APPRAISAL – 7½ TIPS FOR SUCCESS

January 30, 2020 | Posted by: Lam Lee

Do you need to get a current value of your property? Then you are going to need an appraisal. Banks and other lending institutions want to know the “current” market value of your home bef ...

read moreSTRESS TEST RATE & RECENT DECREASE

January 23, 2020 | Posted by: Lam Lee

Currently, all borrowers in Canada need to qualify for a new mortgage at the current Bank of Canada Benchmark Qualifying Rate or at their approved mortgage interest rate plus 2.0%, whichever is higher ...

read moreRAISE YOUR CREDIT SCORE IN 3 MONTHS

January 16, 2020 | Posted by: Lam Lee

While people often think of mortgage brokers when they are first time home buyers, we can help people in a variety of different ways.Recently Garrett LaBarre of Calvert Home Mortgages in Calgary share ...

read more3 THINGS YOU MAY NOT KNOW ABOUT CASH-BACK MORTGAGES

January 9, 2020 | Posted by: Lam Lee

About twice a year, one of the big Canadian banks likes to run an advertising campaign for their cash back mortgages. These are mortgages usually with 5 year terms where you receive a certain percenta ...

read moreWHAT IS A MORTGAGE BROKER?

January 2, 2020 | Posted by: Lam Lee

You may have noticed that there are many different terms for those of us who work in the mortgage industry besides “broker”.Mortgage: specialist, expert, advisor, associate, officer, etc. ...

read more4 COSTS TO CONSIDER AS A FIRST-TIME HOMEBUYER

December 26, 2019 | Posted by: Lam Lee

Oftentimes even the most organized and detail oriented first-time homebuyer can overlook some unexpected costs that come with the purchase of their new home. We are outlining 4 of the costs that we mo ...

read moreHOW TO SAVE MONEY ON A VARIABLE RATE MORTGAGE

December 19, 2019 | Posted by: Lam Lee

A few years ago, I remember seeing a statistic that said that if you took out a variable rate mortgage instead of a fixed rate, you would do better in 95 out of the last 100 years. Often the spread be ...

read moreCREDIT REPORTS: YOU’VE SCORED! BUT ARE YOU PLAYING THE GAME?

December 12, 2019 | Posted by: Lam Lee

For most people, your personal credit score and how a credit score is calculated are complete mysteries. How can you be expected to play and be successful if you aren’t even told the rules of th ...

read more4 WEIRD THINGS LENDERS ASK FOR

December 5, 2019 | Posted by: Lam Lee

A number of times I have had people who wonder why they need to provide so much documentation when it comes to arranging a mortgage. Besides an employment letter, you are usually asked to provide a pa ...

read moreFORECLOSURE, BANKRUPTCY, CONSUMER PROPOSAL & CREDIT COUNSELING

November 28, 2019 | Posted by: Lam Lee

The Canadian Bankers Association’s latest reporton mortgage delinquency shows that Saskatchewan has the highest per capita of all the provinces. The national average shows that .24% of home ...

read moreWHAT IS A MORTGAGE “REFINANCE” AND HOW DOES IT AFFECT ME?

November 21, 2019 | Posted by: Lam Lee

Refinancing a Home is one of those things where people understand what it is but have trouble explaining How it works. To put it simply, refinancing your Home allows you to access the equity you have ...

read moreSHOULD YOU PAY DOWN YOUR MORTGAGE ASAP?

November 14, 2019 | Posted by: Lam Lee

One of the top questions we get asked: Should I pay down my mortgage as fast as possible? In theory, this makes sense. The faster you pay it down, the faster you get out of debt, right? For many peopl ...

read more20 TERMS THAT HOMEBUYERS NEED TO KNOW

November 7, 2019 | Posted by: Lam Lee

Buying a home is one of the most important financial decisions you will make. It’s common for a first-time homebuyer to be overwhelmed when it comes to real estate industry jargon, so this BLOG ...

read more5 MORTGAGE TIPS TO HELP YOU AFFORD A HOME

October 31, 2019 | Posted by: Lam Lee

Buying a home is more difficult now than ever—and this is not news to anyone! No matter where you live, the recent stress testing measures, increase in housing prices in major cities, and contin ...

read moreMILLIONAIRES AND REAL STATE

October 24, 2019 | Posted by: Lam Lee

Andrew Carnagie was one of the richest men in America over 100 years ago. Today his wealth would be worth $4.6 billion dollars. He was a shrewd businessman. While he made most of his money in oil and ...

read moreWE CAN FIX YOUR CREDIT PROBLEMS

October 17, 2019 | Posted by: Lam Lee

Many people do not realize that Dominion Lending Centres mortgage professionals can help you with your credit and get you to a point where you will qualify for a mortgage. We have been doing this for ...

read moreA BANK THAT MAY NOT BE FAMILIAR TO YOU

October 10, 2019 | Posted by: Lam Lee

Quiz time! Who is the largest non-bank mortgage originator in Canada with over $100 billion dollars in mortgages under administration? Answer – First National Financial Corporation. If you&rsquo ...

read moreHOW TO GET A 5% DOWN PAYMENT FOR A $500,000 PURCHASE

October 3, 2019 | Posted by: Lam Lee

We have seen a return of the buyers’ market and many people are asking, how long will this last? While some renters without a down payment might be asking, how can o put a plan in place to own? ...

read more4 HOME IMPROVEMENTS THAT WILL PAY YOU BACK

September 26, 2019 | Posted by: Lam Lee

Some home improvements provide more of a payback when you sell the house down the road. Here’s a list of the four home improvements which will provide the biggest payback when you sell. &nbs ...

read more5 REASONS TO CONSIDER BUYING A CONDOMINIUM APARTMENT OR TOWN HOME

September 19, 2019 | Posted by: Lam Lee

If you are thinking about purchasing a home in the near future, here are some reasons you may consider buying a condo apartment or town home. You should also be aware there are some cons as well. Pro ...

read moreWHO REALLY SETS INTEREST RATES?

September 12, 2019 | Posted by: Lam Lee

A recent article in the Huffington Post addressed the pricing strategy for the Big Six Banks, BMO, CIBC, National Bank, RBC, Scotia and TD and who really sets interest rates. RBC announcing a ra ...

read more3 STEPS TO TAKE YOU FROM PRE-APPROVAL TO GETTING THE KEYS

September 5, 2019 | Posted by: Lam Lee

Picture this: You’ve finally been able to put away enough for a down-payment on your dream home. It’s taken you five years of diligent saving, but you did it! You have also been diligently ...

read moreHOME BUYER TAX CREDIT

August 29, 2019 | Posted by: Lam Lee

When you purchase a home as a first time home buyer, you have a third benefit on top of the First Time Home Buyers’ Program and the Home Buyers Program- the Home Buyer Tax Credit. The Home Buye ...

read moreWHICH MORTGAGE LENDER IS BEST FOR YOU?

August 22, 2019 | Posted by: Lam Lee

The following is a summary of the choices available for clients when looking at the four different types of lending groups. So what exactly is a lender? By simple definition, a mortgage lender provid ...

read moreHOME BUYERS’ PLAN

August 15, 2019 | Posted by: Lam Lee

The Home Buyers’ Plan is a Canada wide program that allows individuals to withdraw a certain amount from their Registered Retirement Savings Plans (RRSPs) for the purposes of qualifying for a ho ...

read moreCREDIT CARDS FOR THE CREDIT CHALLENGED

August 8, 2019 | Posted by: Lam Lee

If you want to buy a home and don’t have a bucket load of cash – you are going to need a mortgage. In order to get a mortgage, you are going to need credit… When you get a mortgag ...

read moreDEBT: TO CONSOLIDATE OR NOT TO CONSOLIDATE? THAT IS THE QUESTION

August 1, 2019 | Posted by: Lam Lee

If you are a Canadian living in debt, you are not alone. According to Statistics Canada, household debt grew faster than income last year, with Canadians owing $1.79 for every dollar of household disp ...

read more6 WAYS TO GET A DOWN PAYMENT

July 25, 2019 | Posted by: Lam Lee

When is it time to think about saving for a down payment? I would say about a year before you think about buying a home. While that’s ideal in today’s world, we often do not have much time ...

read moreMAKING THE MOST OF YOUR VARIABLE MORTGAGE

July 18, 2019 | Posted by: Lam Lee

Working with your DLC mortgage professional can save you thousands of dollars by making the most of your variable rate mortgage in a shifting market. In the past year we have seen an increase in the ...

read moreRENOVATING? CONSIDER A REFINANCE PLUS IMPROVEMENTS

July 11, 2019 | Posted by: Lam Lee

Let’s take a closer look at how a Refinance Plus Improvements mortgage can get you the extra cash you need to get your renovations completed. The Standard Refinance An everyday refinance allow ...

read moreBUILD A PLAN TO MOVE INTO YOUR HOME

July 4, 2019 | Posted by: Lam Lee

There’s nothing quite like stepping into your dream home for the very first time. You have achieved your goal of homeownership! However, the journey from home seeker to home buyer can be challe ...

read moreDO YOU UNDERSTAND THE B-20 GUIDELINES?

June 27, 2019 | Posted by: Lam Lee

A new survey has emerged showing that out of 1,901 owners and would be homeowners, 43% (more than two out of five) Canadians are not confident in their knowledge of the mortgage stress tests ...

read moreWHO PAYS YOUR MORTGAGE BROKER? NOT YOU!

June 20, 2019 | Posted by: Lam Lee

If you’re looking to get a mortgage and considering a mortgage broker, there’s a good chance you’re wondering about how much the service costs. Good news! Clients looking to get a s ...

read moreSOLE PROPRIETORS

June 13, 2019 | Posted by: Lam Lee

Sole proprietors are individuals who run their own business and do not have it set up as a corporation or partnership. The biggest difference between them and a corporation is that a sole proprietor d ...

read more5 THINGS NOT TO DO BEFORE CLOSING ON YOUR NEW HOME

June 6, 2019 | Posted by: Lam Lee

1. Change your job. You were qualified for your mortgage financing based on your income, years at the job and the understanding that you were there for a while. Changing jobs should be put off u ...

read moreACCESSING YOUR HOME’S EQUITY TO INVEST

May 30, 2019 | Posted by: Lam Lee

To tap into your home’s equity, it all starts with refinancing your home. If you own a home, the equity you have built up in it is one of the most valuable assets you have available to you. It i ...

read moreHOW TO PICK THE BEST MORTGAGE FOR YOUR SITUATION!

May 23, 2019 | Posted by: Lam Lee

Most Canadians are conditioned to think that the lowest interest rate means the best mortgage product. Although sometimes that is true, a mortgage is much more than just an interest rate. You can save ...

read moreINCOME QUALIFIED

May 16, 2019 | Posted by: Lam Lee

There are several different ways a borrower can qualify for a mortgage when it comes to their income. One of the most common ways is known as income qualified. All of the following methods of employme ...

read more3 “RULES OF LENDING” – WHAT BANKS LOOK AT WHEN YOU APPLY FOR A MORTGAGE

May 9, 2019 | Posted by: Lam Lee

Buying a home is usually the biggest purchase most people make and there are a lot of factors to consider. Our job is to provide you with a much information (as you can handle!!) so you make the best ...

read moreWHAT IS AN UNINSURABLE MORTGAGE?

May 2, 2019 | Posted by: Lam Lee

With the mortgage rule changes in recent years, lenders have had to make some adjustments to their rate offerings. There are different tiers and rate pricing based on the following 3 categories:1) In ...

read moreWOULD A CO-SIGNER ENABLE YOU TO QUALIFY FOR A MORTGAGE?

April 25, 2019 | Posted by: Lam Lee

There seems to be some confusion about what it actually means to co-sign on a mortgage… and any time there is there is confusion about mortgages, it’s time to chat with your trusted Domin ...

read moreZERO DOWN PAYMENT MORTGAGE–DOES IT EXIST?

April 18, 2019 | Posted by: Lam Lee

Did you know that you can buy a home with ZERO down payment?? If a home purchase is your goal this year but you aren’t able to save up enough of a down payment, you may qualify for a low or zero ...

read moreTRANSFERS AND SWITCHES

April 11, 2019 | Posted by: Lam Lee

Transfer/Switches are when you opt to transfer your mortgage to a new lender in order to take advantage of a lower rate. A transfer/switch does not include additional money to the existing mortgage ba ...

read moreMINIMUM DOWN PAYMENTS

April 4, 2019 | Posted by: Lam Lee

Are you looking for that new dream home, or anything that will get you out of your current rental property so you can officially become a homeowner? If so, what is the minimum amount you are required ...

read more5 REASONS WHY YOU DON’T QUALIFY FOR A MORTGAGE

March 28, 2019 | Posted by: Lam Lee

It’s not just because of finances. As a mortgage broker I receive calls from people who want to know how to qualify for a mortgage. Most of the time it comes down to finances but there are othe ...

read moreHOW DO YOU KNOW WHEN YOU’RE READY TO BUY HOUSE?

March 21, 2019 | Posted by: Lam Lee

Here are 7 signs that you’re ready to buy your first home… 1. You have saved enough for the down paymentMost people think the biggest hurdle to overcome when buying a house is saving up ...

read moreREADING THIS COULD SAVE YOU MONEY (HOW TO RENEW YOUR MORTGAGE IN 5 EASY STEPS)

March 14, 2019 | Posted by: Lam Lee

If you have a mortgage, chances are unless you win a lottery (cha-ching $$$) you’ll be doing a mortgage renewal when your current term has finished. While most Canadians spend a lot of time, an ...

read moreWHAT QUESTIONS TO ASK WHEN CONSIDERING A REFINANCE

March 7, 2019 | Posted by: Lam Lee

Many of my clients and friends regularly ask me when or if they should consider a refinance. Here are 4 quick questions that I ask of them. The answer they give me, will very quickly tell me if we sho ...

read morePRE-APPROVALS & PRE-QUALIFICATIONS

February 28, 2019 | Posted by: Lam Lee

Throughout the mortgage and home buying process, there are many steps and many checkpoints a buyer will need to complete before they can move on to the next one. A buyer will not be able to close on a ...

read moreFIRST TIME HOME BUYERS

February 21, 2019 | Posted by: Lam Lee

Your First Home. What a THRILLING thing that is to think about!! One of the best parts about our job is helping individuals purchase their first home. We know that the process can seem daunting at fir ...

read moreBUYING YOUR FIRST HOME? – THESE TIPS WILL SAVE YOUR LIFE

February 14, 2019 | Posted by: Lam Lee

So you’re wanting to buy a new home? That is some very exciting news. First question, are you prepared?!We all know big-item purchases are scary. It’s expensive, you are fully committing t ...

read more5 REASONS WHY REALTORS WANT YOU TO HAVE A PRE-APPROVAL

February 7, 2019 | Posted by: Lam Lee

You’ve decided that you want to buy a home and you call up a realtor to show you a listing and the first question they ask is “ How much are you pre-approved for?” Many realtors will ...

read more5 C’S OF CREDIT TO GET A MORTGAGE

January 31, 2019 | Posted by: Lam Lee

Whether you are buying your first home or have been a home owner for years, when you are looking at purchasing a property, finding the best mortgage solution for your specific situation can be an inti ...

read moreBANK VS. CREDIT UNION – A WHO IS WHO IN BORROWING

January 24, 2019 | Posted by: Lam Lee

Banks and Credit unions are often grouped together into one category under “financial institutions”. While they may have several similarities in terms of financial service offerings, in th ...

read moreRRSP – USE HOME BUYERS’ PLAN (HBP) MORE THAN ONCE

January 17, 2019 | Posted by: Lam Lee

Under the home buyers’ plan, a participant and his or her spouse or common- law partner is allowed to withdraw up to $25,000 from his or her RRSP to buy a home. Before 1999, only the first- time ...

read more5 WAYS YOU CAN KILL YOUR MORTGAGE APPROVAL

January 10, 2019 | Posted by: Lam Lee

So, you found your dream home, negotiated a fair price which was accepted. You supplied all the needed documentation to your mortgage broker and you are waiting for the day that you go to the lawyer&r ...

read moreREFINANCING IN 2018

January 3, 2019 | Posted by: Lam Lee

Recently there were changes to the mortgage rules yet again, and one of the rule changes was regarding refinancing your home. At one point in the last 10 years you could refinance your home all the wa ...

read moreWHAT’S AN ACCEPTABLE DOWN PAYMENT FOR A HOUSE?

December 27, 2018 | Posted by: Lam Lee

Ask people this question and you will get a variety of answers. Most home owners will say 10% is what you should put down. However, if you speak with your grandparents, they are likely to sugges ...

read moreMORTGAGE PREPAYMENT(S)- THE PERFECT HOLIDAY GIFT!

December 20, 2018 | Posted by: Lam Lee

Do you know what kind of prepayment privileges you currently have with your mortgage? Does your current lender allow you to make a 10% prepayment or a 20% prepayment on your principle amount? Can you ...

read moreTHE #1 MISCONCEPTION ABOUT MORTGAGE FINANCING!

December 13, 2018 | Posted by: Lam Lee

It is a reoccurring but common misconception that you will qualify for a mortgage in the future because you have qualified for a mortgage in the past. This is not accurate! Do. Not. Assume. Anything ...

read moreVARIABLE RATE? TO LOCK IN OR NOT?

December 6, 2018 | Posted by: Lam Lee

This post applies if you are taking a new mortgage, whether it’s for a purchase, refinance, or renewal. The variable remains the main contender. But what about all the economists saying if you ...

read moreLOOKING FOR A MORTGAGE… YOU BETTER KNOW YOUR CREDIT SCORE

November 29, 2018 | Posted by: Lam Lee

Over the last month, as the big banks and many of our monolines mortgage lenders wind down their fiscal year, we are starting to see some very obvious changes in what your credit score can get you. I ...

read moreMORTGAGE INTEREST RATE TIERS

November 22, 2018 | Posted by: Lam Lee

Since we know that lenders can back-end insure our mortgages (please read our Mortgage Insurance Market and Wholesale Lenders article first), and that this specifically makes these mortgage ...

read more4 FACTS ABOUT USING A GUARANTOR

November 15, 2018 | Posted by: Lam Lee

A Guarantor, when it comes to mortgages, is exactly what it sounds like—they “Guarantee” the mortgage for another person if they are unable to pay back the loan. Guarantor’s o ...

read more5 GREAT REASONS TO PROVIDE A 20% DOWN PAYMENT WHEN BUYING A HOME

November 13, 2018 | Posted by: Lam Lee

There are many challenges that come into play when you’re in the market to buy a home.Buyers say the number one obstacle to home ownership is saving enough for a down payment, the amount that th ...

read morePRE-APPROVED FOR YOUR MORTGAGE… WHAT DOES THAT REALLY MEAN?

November 8, 2018 | Posted by: Lam Lee

There is a myth out there that once you’re pre-approved for a mortgage, you’re good to go out and buy a home… with a no subject offer… DON’T do it! A pre-approval mean ...

read moreWHAT IS A MONOLINE LENDER?

November 5, 2018 | Posted by: Lam Lee

What usually follows once someone hears the term “Monoline Lender” for the first time is a feeling of suspicion and lack of trust. It’s understandable, I mean why is this “bank ...

read moreA GUIDE TO YOUR HOME BUYERS’ PLAN

November 2, 2018 | Posted by: Lam Lee

Start at the beginning…Registered Retirement Savings Plan = one of the best ways to save for retirement and your down payment and continuing your education. With an RRSP, your contributions red ...

read moreDOCUMENTS YOU NEED FOR YOUR MORTGAGE PRE-APPROVAL

November 2, 2018 | Posted by: Lam Lee

Being fully pre-approved means that the lender has agreed to have you as a client (you have a pre-approval certificate) and the mortgage broker has reviewed and approved ALL your income and down payme ...

read moreHOW TO GET A FREE COPY OF YOUR CREDIT BUREAU

November 1, 2018 | Posted by: Lam Lee

Think of your credit score as a report card on how you’ve handled your finances in the past. A credit score is a number that lenders use to determine the risk of lending money to a given borrowe ...

read moreRATES ON THE RISE BOTH VARIABLE & FIXED

October 25, 2018 | Posted by: Lam Lee

With the Bank of Canada in a mood to raise rates, it’s a similar feeling for the bond market, which impacts fixed rates. In every interest-rate market there are many factors leading to an increa ...

read more7 THINGS EVERY SELF-EMPLOYED INDIVIDUAL SHOULD KNOW — BEFORE YOU APPLY FOR A MORTGAGE

October 18, 2018 | Posted by: Lam Lee

Self-employed individuals are quickly becoming one of the most common clients that we handle. Daily we have successful business owners come into our offices who enjoy the perks of being an entrepreneu ...

read moreBANK OR MORTGAGE BROKER?

October 11, 2018 | Posted by: Lam Lee

Mortgages are like vehicles. A bank is similar to the brand, Ford or Toyota for example. How long you have a mortgage before it’s time to renew is like the model, a Fusion or Camry. The rate is ...

read moreMORTGAGE INSURANCE 101

October 4, 2018 | Posted by: Lam Lee

For a first-time home buyer, the types of insurance surrounding a mortgage can be confusing, so it’s important to know what insurance covers what. There are 3 main types of insurance to know ab ...

read moreALL ABOUT PRE-APPROVALS

September 27, 2018 | Posted by: Lam Lee

Are you in the market for a new home? That’s great – but if you’re not already pre-approved from your mortgage broker, be sure to read on. Pre-approvals are very important for two r ...

read moreWHAT TO LOOK FOR IN A MORTGAGE BROKER

September 27, 2018 | Posted by: Lam Lee

Are you on the hunt for a mortgage broker? Or you need a mortgage broker but just don’t know it yet! Either way, this article is for you! First up, where do you find a Mortgage Broker? The eas ...

read moreRENT, OWN, OR DO BOTH?

September 20, 2018 | Posted by: Lam Lee

There are generally three different situations you can find yourself in when it comes to living situations; living with parents, renting, or owning. A lot of the times the first decision someone will ...

read moreDON’T FORGET THE CLOSING COSTS WHEN YOU PURCHASE A HOME

September 14, 2018 | Posted by: Lam Lee

Of course, these are estimates — the actual amount you will need could be higher or lower, depending on factors like where you live, the type of home you’re buying, or if it’s a new ...

read moreFIRST TIME MORTGAGES: EXPECTATIONS VS. REALITY

September 13, 2018 | Posted by: Lam Lee

First-time homebuyers are one of our favourite clients! It’s great to work alongside them and teach them the in’s and out’s about real estate, owning a home, and helping them cross & ...

read moreKEEPING YOUR CREDIT SCORE HEALTHY

September 12, 2018 | Posted by: Lam Lee

There is a lot of misinformation floating around about credit bureaus, credit reports and credit scores – not only that, but a large amount of the clients I work with have never even seen t ...

read moreLAST MINUTE CREDIT CHECK

September 10, 2018 | Posted by: Lam Lee

As I’ve said many times, one of the single greatest determining factors in whether you can become qualified for a mortgage and the interest rate at which you do, is your credit history. Many peo ...

read moreMORTGAGE SWITCHES AND TRANSFERS

September 6, 2018 | Posted by: Lam Lee

Mortgage switches and transfers are becoming one of the more popular sources of revenue for certain lenders which means great incentives for borrowers as the banks and financial institutions fight for ...

read moreREVERSE MORTGAGE – COMMON USES

September 4, 2018 | Posted by: Lam Lee

Here is the final blog in the REVERSE MORTGAGE series. If you missed the first two, you read them here and here: Eliminate mortgage payment – Retired, or wanting to retire, ...

read moreYOUR MORTGAGE BROKER IS HERE TO HELP

August 31, 2018 | Posted by: Lam Lee

For many people in Canada, they are first-time home buyers. Or if they are new to Canada, it’s their first home purchase in a new country. They may not be aware of the rules and guidelines. It&r ...

read moreBRIDGE LOANS

August 30, 2018 | Posted by: Lam Lee

If you have ever sold your home in order to help with the purchase of your next home, chances are you have heard of bridge financing. Bridge financing is an option available to homeowners if they find ...

read moreMORTGAGE BROKERS HAVE SOLUTIONS

August 20, 2018 | Posted by: Lam Lee

A lot of people are getting stressed out by Canada’s new mortgage stress test. In the past, if you had a good sized down payment (ie 20%) someone with a low income could purchase a home even if ...

read more7 SURE-FIRE WAYS TO GROW YOUR CREDIT SCORE

August 16, 2018 | Posted by: Lam Lee

Have you ever wished for a simplified guide on how to actually GROW your credit score? Well today is your lucky day! We have had years of experience working with individuals who come to us with poor o ...

read moreA FEW REASONS WHY YOU SHOULD CONSIDER A VARIABLE RATE MORTGAGE

August 13, 2018 | Posted by: Lam Lee

Five-year fixed mortgage rates continued their upward march last week as the five-year Government of Canada (GoC) bond yield they are priced on hit its highest level in seven years. Meanwhile, five-ye ...

read moreFIXED VERSUS VARIABLE INTEREST!

August 9, 2018 | Posted by: Lam Lee

Fixed Interest Rates This is usually the more popular choice for clients when it comes to deciding on which type of interest rate they want. There are many reasons why, but the most unsurprising ans ...

read moreIT’S NOT ALL ABOUT THE RATE: AMORTIZATION & RENEWALS

August 3, 2018 | Posted by: Lam Lee

Have you spoken to a mortgage broker lately? When it’s time to renew your mortgage you have the freedom to do a number of things that are not possible at any other time without a financial penal ...

read moreTHE 3 STEPS THAT TAKE YOU FROM PRE-APPROVAL TO YOUR NEW HOME

August 2, 2018 | Posted by: Lam Lee

Picture this: You’ve finally been able to put away enough for a down-payment on your dream home. It’s taken you five years of diligent saving, but you did it! You have also been diligently ...

read more4 KEY THINGS YOU NEED TO KNOW ABOUT A SECOND MORTGAGE

July 26, 2018 | Posted by: Lam Lee

Many homeowners are vaguely aware of the fact that you can take out a second loan on your home. You hear your friends mention it or perhaps a family member close to you has gone through the process&md ...

read moreREFINANCES, RENEWALS & TRANSFERS

July 19, 2018 | Posted by: Lam Lee

After you have purchased your new home, closed on your new mortgage, and are all moved in, what comes next? Well, when it comes to your mortgage, the next step is to either refinance, renew, or trans ...

read moreAfter the Hike: Fixed or Variable?

July 12, 2018 | Posted by: Lam Lee

It’s the perennial question homebuyers ask themselves and one that’s getting a lot of attention these days: should I go fixed or variable? And the answer may have just become a little m ...

read moreTake Advantage of Low Interest Rates – Refinance Your Mortgage Today!

May 24, 2018 | Posted by: Lam Lee

Borrowers are loving the current record low interest rates, and homeowners stand to benefit even more. If you bought your home more than a few years ago, you could probably benefit from a refinance ...

read moreShould You Spend the Full Mortgage Amount You're Approved For?

May 17, 2018 | Posted by: Lam Lee

Before you start shopping for a new home, you'll need to know exactly how much house you can afford. Otherwise, you could end up in a home that is way out of your budget. What you qualify for may not ...

read more

.jpg)